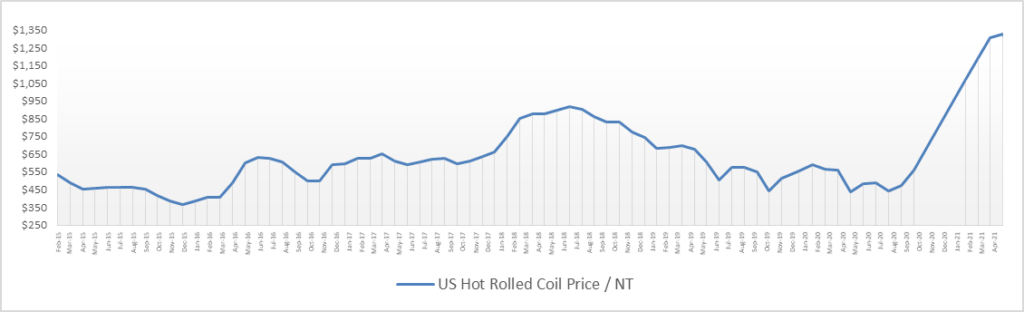

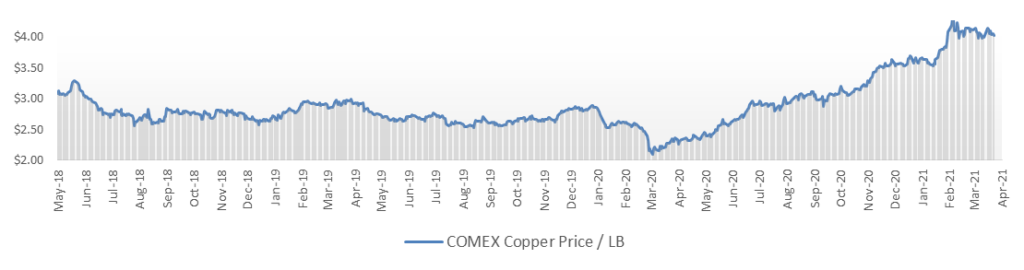

Industrial commodity pricing levels remain at an all-time high. In the past three months, copper has been consistently over $4.00/lb. (new record) and steel has set a new all-time price record every week.

Currently, the CRU price (most trusted and established price source) for steel is $1328/net-ton. While this is 25% higher than our previous 2008 all-time high, steel buyers are reporting prices over $1400/net-ton today (31% above 2008 high).

Steel buyers are struggling to forecast when this market will peak. Steelmakers advise that their supply is currently booked out into June in most cases and even July in some special cases. This means that pipe mills need to purchase their raw material for Q3:2021 now. In previous outlooks, we looked at the balance of supply vs. demand to gain a better understanding of why this is happening. Many speculate but it seems quite impossible to fully understand how this market continues to support steel pricing as high as we are seeing.

Steel Market Update, part of the CRU Group, performs monthly polling of vetted steel mills, service centers and manufacturers to predict future steel trends. In Dec 2020, experts predicted the peak in Feb 2021. In Feb 2021, experts predicted the peak in March 2021. Currently, experts predict this peak to be in early May 2021.

Category price and lead time update:

- Domestic A53B GrB, A53F GrA & A135/A795 Pipe – In many cases, steel pipe has doubled since early 2020. Most steel buyers agree that the pricing cannot drive much higher above today’s number. We encourage buyers to inquire deeply into lead times when quoting and procuring material lists.

- Import A53B GrB – Importers cannot keep inventory on the ground. With the escalated domestic steel price, import A53B ERW is selling as fast as importers can lay it down. Current cost reduction is >15% compared to domestic ERW.

- A106 Domestic Seamless – 5% took effect in Q1:2021. 6% increase anticipated in Q2:2021. (could affect WPB weld fitting pricing)

- Copper Tubing – China, who consumes >50% of our world’s copper, is reporting 8.3% YoY GDP growth as they plan to vaccinate 40% of their population by June (currently at 3.8% vaccinated). This disclosed demand could also be amplified by China’s panic buying in fears of COVID shutdowns as Chile (world’s top exporter of copper) closed its borders for April reporting an all-time high for infections. Inventories at London Metal Exchange (LME) along with China bonded warehouses are at 10-year lows (lower inventories results in greater purchases driving higher prices).

- Domestic Weld Fittings & Flanges – The 2018 ~7.5% increase on weld fittings remains in effect. We could see another 7% increase on WPB weld fittings if A106 seamless prices continue to rise. Lead times have greatly improved for commodity material.

- Import Weld Fitting & Flanges – The market has seen a ~6% increase on import fittings (WPB) and flanges (A105) in Q1 2021. 2020 showed significantly reduced prices from large inventories coming off-shore from quarantined material awaiting trade case determinations. We will see another ~6% increase in Q2:2021 for WPB or A105 material.

- Copper Sweat / Press – Sweat fittings increased 40% in 2020. Considering the persisting volatility in raw material pricing, we expect to see further increases in the near future.

- Iron Fittings / Welded Nipples – Steel scrap, used to make iron fittings, has doubled in the past 12 months. CW pipe, used to make welded nipples, has seen its raw material double in the past 12 months as well. We have already seen 22% increases in 2020 and expect another 14% by Q2:2021. Price should normalize as soon as steel scrap and hot rolled coil stabilize. Lead times are very low.

- Hangers, Strut & Threaded Rod – In the trade reform of 2018, increases up to 24% took hold on hanging systems. The majority of these increases remain in place.

- Bronze & Iron Valves – All of the commercial and industrial valve manufacturers had several increases in 2018. We saw 3-10% in Q3:2018 and another 5-12% in early 2019, followed by 7% in 2020. We expect a 7% increase by Q2 2021.

- Victaulic Grooved Product – 8% increase took effect in Q2:2021. Lead times on fire protection are pushing out.

- Stainless Steel Pipe, Fittings & Flanges – We expect to a 7-10% increase in stainless sometime in 2021 stemming from a strong nickel price.

- Forged Steel Fittings / Seamless Nipples – 10% increase took effect in Q2:2021.

- Forged Steel & Cast Steel Valves – 2018 tariff driven price increases of 15-25% remain in effect. Lead times still a challenge for these categories.